Financial services marketers bear the heavy responsibility of ensuring all communications and advertisements are compliant with regulatory requirements. The lingering effects of the pandemic, high inflation rates, and an increased focus on digital currency have regulators more vigilant than ever.

Balancing creativity, clarity, and compliance means financial services Marketers must consider many variables when submitting content for approval. Here’s what to know.

What is financial services compliance?

Financial services compliance means adhering to the laws and rules set by a local regulatory body. Financial institutions report to self-regulatory organizations, which set their own rules in accordance with the government’s laws and directly monitor activity within the finance industry. These SROs work to prevent financial crimes like cyber attacks on customer data privacy, promote anti-money laundering (AML) practices, and provide consumer protection safeguards. They also monitor advertisements and communications to make sure they’re compliant.

Most countries have their own SROs; some of the most commonly referenced ones are the Financial Industry Regulatory Authority (FINRA) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the Australian Securities and Investments Commission in Australia (ASIC). The existence of SROs creates an extra layer of protection between financial institutions and the government, meaning that non-compliant companies are sometimes given the opportunity to rectify mistakes before dealing with official government sanctions and penalties.

What disclaimers and disclosures should financial Marketers use in content?

Disclaimers and disclosures are an integral aspect of financial services compliance. Marketers use them to inform the public, their clients, and anyone reading their communications of the potential risks or additional information they need to know to understand the rest of the communication accurately. Here are a few examples:

Simulated past performance. When referring to a hypothetical investment that did not involve actual monetary gain, Marketers need to follow the relevant SRO’s rules and clearly explain that the situation is an example.

Investment risk. Many SROs restrict pushing high-risk investments over lower-risk ones. Financial services Marketers may need to point potential investors to lower-risk investments in a disclaimer or disclosure.

Comparison rate. Any comparisons to competitors must provide the context necessary to make the claim true, such as the date of the comparison, exclusions and exceptions, or that prices and fees are subject to change.

Omitting key language could lead to millions of dollars in financial services compliance fines in some situations.

Another common risk with disclaimers and disclosures is if a company’s language isn’t up to date with recent regulatory changes and mandates. This can be especially challenging if internal documentation isn’t organized and updated regularly. Click here for a full list of disclaimers and disclosures Marketers should use in the financial services industry.

What high-risk language should financial Marketers avoid?

Certain high-risk language can be problematic in financial services marketing. For example, superlatives may be considered non-compliant if claims can’t be proven.

Here are a few examples:

Best: This claim usually can’t be substantiated, and even if it can, it can almost always be disputed.

Free: “Free” doesn’t only apply to money; it applies to a potential customer’s time as well. Requiring that potential client to fill out a lengthy survey to get something for “free” could be flagged as misleading advertising by the local SRO.

Guarantee: A lot can change between the time a company promises something and the time it executes that promise. Businesses can’t “guarantee” anything.

Click here for a list of the seven compliance-risk words financial Marketers should avoid using in their content.

What are the most important resources for financial marketers?

Most finance industry SROs have a specific rule that applies to communications and advertisements, and that’s usually the most important rule for Marketers to know.

FINRA Rule 2210

According to the United States’ main compliance rule for Marketers:

- Companies must file most communications with FINRA 10 days before publication.

- Companies must keep records of marketing communications for a minimum of three years.

- Public appearances also must also follow FINRA guidelines. This includes speeches and recorded seminars.

Click here for a full breakdown of FINRA Rule 2210.

FCA’s COBS 4

Based on the United Kingdom’s main compliance rule for Marketers:

- Companies must maintain records of all advertisements for at least six years.

- Direct Offer Financial Promotions and Non-Readily Realisable Securities require special attention. These two types of products follow different regulations than the other marketing communications.

- Ads must follow additional rules in the UK. They must also follow Committees of Advertising Practice (CAP) and Advertising Standards Authority (ASA) rules.

Click here for a full breakdown of the FCA’s COBS 4.

ASIC Regulatory Guide 234

ASIC’s Regulatory Guide 234 is Australia’s primary marketing rule, covering elements such as:

- While it is listed elsewhere in ASIC’s financial regulations, ASIC requires companies to keep records of their communications for seven years after use.

- The “tone” of advertisements cannot overshadow any possible risk to the potential client.

- Companies cannot advertise that they are impartial or independent if they are receiving referrals or commissions.

Click here for more details about FINRA Rule 2210, the FCA’s COBS 4, and the FTC’s Truth in Advertising.

How financial services Marketers can speed up compliance reviews of content

One of the biggest compliance challenges that financial Marketers face is the approval process. Legal teams need time to understand the scope of a project and check language word by word to make sure it’s correct. For Marketers, that means one thing — delays.

Here are three ways to minimize delays for a smoother compliance approval process:

- Set up a quarterly pain-point meeting between marketing and legal.

- Hold regular lunch-and-learn sessions to keep on top of regulatory or brand compliance updates.

- Have marketing and legal sit in on each other’s meetings (where relevant) to understand one another’s workload and upcoming review volumes.

Click here for more detailed explanations of how to speed up the compliance process.

Simplify the compliance approval process With Red Marker

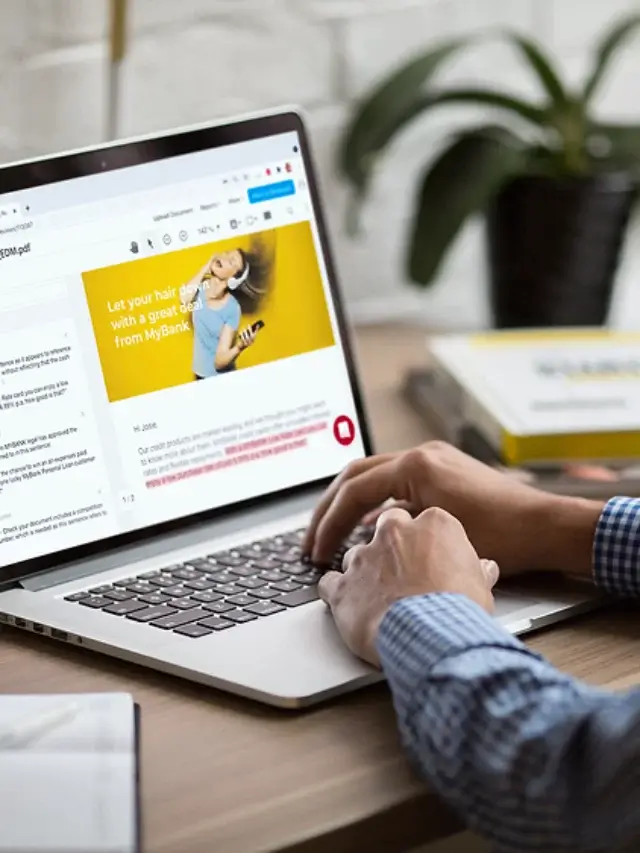

Writing compliant marketing materials is a complex process, especially for Marketers who may have little or no formal training in compliance programs or initiatives. This is where Red Marker can help.

We are the only marketing compliance platform to focus on the needs of marketing and legal and compliance. Our platform uses AI and automation to detect marketing copy that doesn’t meet an SRO’s regulatory compliance requirements, so users can amend content before sending it for review, accelerating review timelines by up to 30x. In addition, our RiskGPT functionality caters to time-poor Marketers by suggesting replacement copy for risky content in accordance with local regulations such as FINRA, FCA, ASIC, and or any other relevant guidelines.

Click here if you’d like to schedule a 30-minute call to discuss how to enhance the efficiency of your current financial services compliance processes and address your specific needs.

NOTE: This post isn’t a substitute for legal or regulatory advice; please seek legal counsel on compliance-related issues.