Financial services is a minefield of ever-changing laws and regulations, no matter where you’re located. If you don’t have a background in compliance, memorizing lengthy regulations and keeping on top of new rules as a financial services marketer can be intimidating.

We’ve got you covered with this post. You’ll learn about three major financial services regulations in the US and UK, including details about how they will impact marketing.

1. FINRA: Rule 2210

FINRA is a self-regulatory organization (SRO) that is the most important governing body of rules you’ll use for financial services marketing in the United States.

The organization’s Rule 2210 covers communications with the public and was passed in response to social media and the emergence of other new marketing channels. Here are the most important compliance requirements that every admin should know about Rule 2210:

- It covers three categories of communication: retail, correspondence, and institutional.

- Most communications must be filed with FINRA 10 days prior to publication.

- You must keep a record of your marketing communications for at least the past three years that include the date the communication was first used, the title and name of the person who approved the communication, a copy of the communication itself, and the source of images, graphs, statistics, or charts in the communication.

- Include a BrokerCheck link where applicable. BrokerCheck, a free tool from FINRA, allows users to research the background of brokers and brokerage firms.

- Include necessary disclosures with any testimonials. These include whether or not the testimonial was paid for, that it is not a guarantee of future performance or success, and that it may not be representative of other clients’ experiences.

For a more in-depth explanation of this rule, check out this helpful article by Vigilant, LLC or the FINRA Rule 2210 FAQ.

2. FCA: Handbook Chapter 4

The Financial Conduct Authority handbook is the presiding set of content compliance rules for financial services in the UK. Chapter 4, titled “Communicating with clients, including financial promotions,” covers the UK’s rules for advertising within the financial services sector. These rules comply with the European Union Directive 2014/65/EU (Markets in Financial Instruments Directive).

Here are the main points you should be aware of in Chapter 4 of the FCA Handbook:

- You need to understand the relevant “Principles of Business” for financial promotions (Principles 2, 3, 6, and 7).

- You must know the difference between a “real-time” or “non-real time” financial promotion. Real-time financial promotions are done in the moment, like in a meeting or on a call, so they are regulated differently. Non-real time financial promotions don’t involve any simultaneous dialogue and are regulated more strictly.

- You have to maintain records of all advertisements for at least the past six years.

- Know which sections require special attention: Direct Offer Financial Promotions and Non-Readily Realisable Securities. These two product areas follow slightly different regulations than other marketing communications.

- Your ads must comply with FCA rules, as well as the rules of the Advertising Standards Authority (ASA) and Committees of Advertising Practice (CAP).

3. FTC: Truth in Advertising

The Federal Trade Commission’s Truth in Advertising is a set of laws that governs all advertisements in the US. They help protect citizens from unfair or deceptive advertising in any medium.

If you don’t follow the FTC’s Truth in Advertising, you could be subject to civil lawsuits or even fines by the FTC that could add up to millions of dollars (like this recent penalty of $1.5 million).

The most important areas for financial marketers to focus on are the FTC’s three fundamental rules of advertising and its fou

The FTC’s three fundamental rules of advertising are:

- Your advertisement must be truthful.

- Your advertisement cannot be deceptive or unfair.

- Your advertisement must be evidence-based.

The 4 Ps of the FTC:

- Placement—You must put disclosures close to the claims they qualify.

- Proximity—You can’t make users scroll or zoom to see disclosure.

- Prominence—You must make your disclosure stand out on the page.

- Presentation Order—You must make it “unavoidable” that consumers see disclosure before they can proceed.

To learn more about the FTC’s Truth in Advertising laws, check out the FTC’s “Protecting Consumers from Fraud and Deception” and “The FTC’s Endorsement Guides: Being Up-Front With Consumers.”

NOTE

For our Australian readers, keep the Australian Securities and Investments Commission (ASIC) Regulatory Guide 234 handy as well, as it will be your go-to guide for all marketing compliance efforts in Australia. Here is a helpful resource by Gilbert + Tobin to break it down.

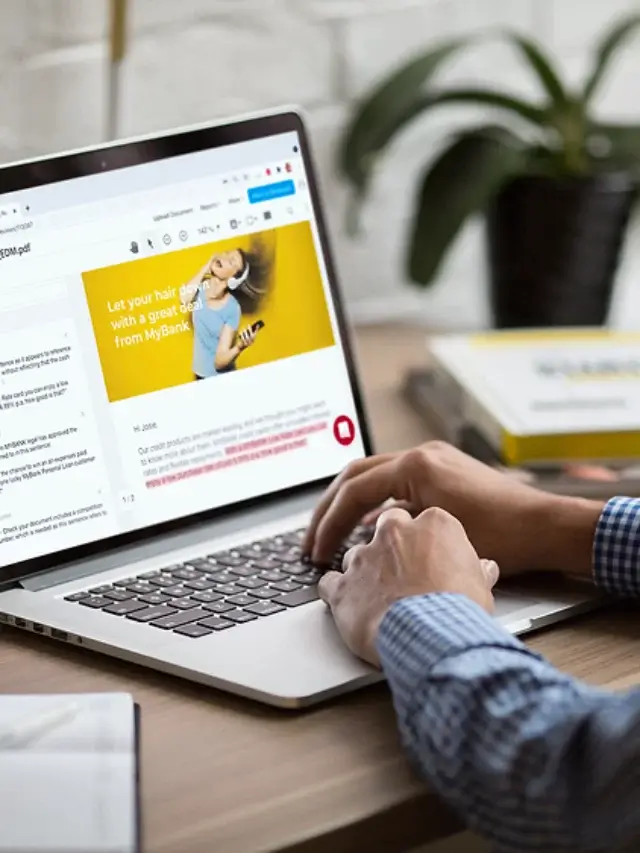

Automatically Abide by These Resources With Red Marker

While it is important to know your local content compliance rules, you can save time by using intelligent tech like Red Marker. With Red Marker, you won’t need to memorize any rules yourself, as our AI is custom-trained, bespoke to the regulations and guidelines applicable to your business. Using automation, we scan your marketing materials against these custom rules, ensuring compliance with FINRA, FCA, the FTC’s Truth in Advertising, or any other relevant regulations.

Click here to contact us if you’d like to book a 30-minute discovery call to walk through your marketing compliance processes and needs.

NOTE: This post isn’t a substitute for legal or regulatory advice; please seek legal counsel on compliance-related issues.