Ensuring content compliance is no small matter for marketers in the financial services industry. FINRA issued over $100 million in fines in 2021, and the SEC recently issued the new marketing rule. Following these financial regulations can help your company avoid heavy fines and maintain a strong reputation.

But unfortunately, compliance does create delays for marketers.

It typically takes legal teams a long time to understand each project’s scope—like reviewing channels and audiences—and check campaign disclaimers word by word to make sure they’re correct. Not to mention that your legal team has to balance your approvals with requests they’re getting from other departments.

The good news is that you can minimize delays between your marketing team and your legal department. Let’s break down some of the best ways to do that.

Set up Regular Meetings Between Marketing and Legal

Compliance mandates and marketing trends are constantly changing, and the relationship between legal and marketing teams should change with them. A good example is the SEC passing its new marketing rule in direct response to social media and the rapid increase in new marketing channels.

Meet regularly with your legal department, so you can stay on top of regulatory changes and marketing trends together. Here are some best practices you can follow to make meetings between marketing and legal more commonplace:

Sit In on Each Other’s Meetings

The simplest way to start gathering? Join each other’s meetings on a monthly basis.

When your legal team attends marketing meetings, they can hear about campaign details. The team can save time during compliance review because they’ll already be familiar with the campaigns and audiences your marketing team is targeting.

On the flip side, marketing team members can learn about the latest regulatory requirements by sitting in on legal meetings. This knowledge will help you and your team create compliant marketing content, which will help speed up the review process.

Hold Monthly Lunch-and-Learn Meetings

Leaders from your legal and marketing teams can take turns hosting these meetings. Each session will be a lesson in compliance requirements or marketing trends, leading to better understanding and a smoother workflow for both departments.

Identify Pain Points Between Legal and Marketing With a Quarterly Meeting

Set up a meeting between your legal and marketing teams to talk about ways they can improve collaboration once per quarter. Ask representatives from each group to gather roadblocks from their team beforehand to share during the meeting. From there, both departments can brainstorm solutions.

The existence of this meeting will reduce the number of critiques and workflow changes during the quarter and will encourage team members to wait until this meeting instead.

Make It Easy for Marketing To Learn About Compliance

Speed up the legal team’s compliance process by helping marketing learn about regulatory compliance with these tips:

Assign a Regulatory SME on the Marketing Team

Designate a single marketing team member to take charge of regulation issues, so you don’t have to constantly ask legal about small compliance issues. This person can take the lead on training the team and checking over work before it’s sent to legal.

Have your SME take a base-level compliance program or course to get a better handle on compliance in content and navigating the review process. However, it’s important to recognize that this specialized knowledge does not make them a lawyer and that marketing assets still need to go through legal review.

Have Legal Create a Centralized Compliance Knowledge Base

Prevent your legal department from getting inundated with questions by having them create a centralized compliance knowledge base. This is an internal resource that the marketing team can reference to find compliance checklists and resources to review their content before sending it to legal. Apps like Tettra and Notion store important financial services compliance information about anti-money laundering (AML), risk management, cybersecurity, financial crimes, compliance risk, consumer protection, or anything else that’s relevant for the marketing team to know.

Develop Project Trackers That Work for Both Teams

It’s easy to mark a campaign as “urgent” for legal approval without thinking twice, especially when deadlines are quickly approaching. But these last-minute, high-priority requests can wear your legal department down. Lawyers in the financial sector are already balancing requests from other departments, so they need advance notice.

Use collaborative technology to set up a project tracking system to keep legal in the loop about upcoming projects that will need approval. You might create a shared status document that includes up-to-date deadlines, ETAs on approval from legal/compliance, priority levels, marketing channels (where it will be visible), and any other relevant information.

You can also use a project management tool, like ClickUp or Monday, to share information with your legal team. Project management tools have useful features like centralized documents and project files, integrations into other apps you use, and the ability to generate a variety of different reports at a moment’s notice, which is especially useful for fintech and financial services organizations.

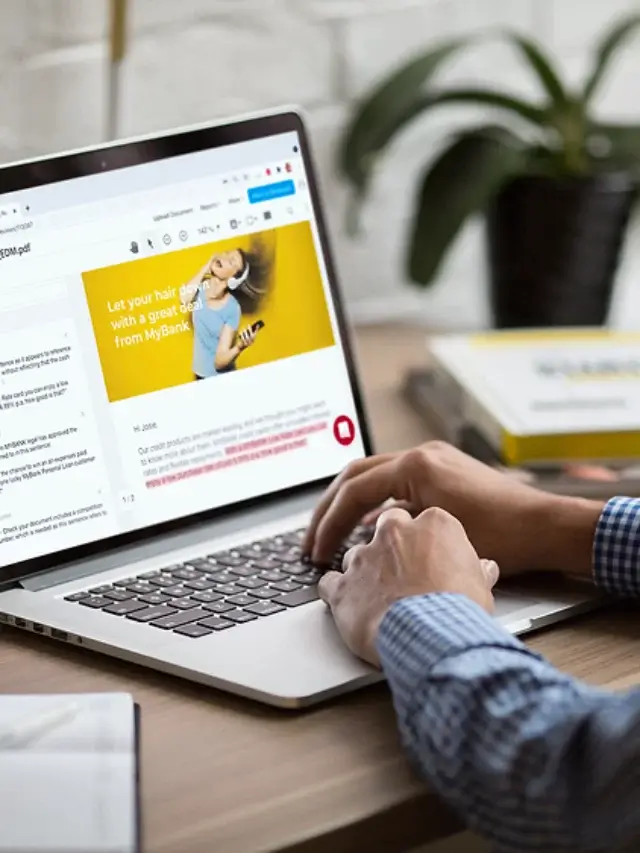

Simplify the Compliance Approval Process With Red Marker

With Red Marker, financial institutions can relegate long content reviews to a thing of the past. Red Marker is a custom-trained AI that makes sure your marketing materials are in compliance with your local laws and regulations for maximum efficiency for all parties. Our software integrates seamlessly with marketing workflow software and project management tools (like Monday.com, Aprimo, Asana and Intelligence Bank) to ensure a smooth and efficient workflow.

Click here to contact us if you’d like to book a 30-minute discovery call to walk through your marketing compliance processes and needs.