Any advertisement designed to promote insurance products, whether life, medical, dental, healthcare, automotive, or any other, must communicate information accurately and clearly to protect consumers. Red Marker’s solution aids insurers’ efforts to maintain marketing compliance with changing regulations through revolutionary technology.

The Marketing Compliance Solution for Insurance

Mitigate Risk with Red Marker

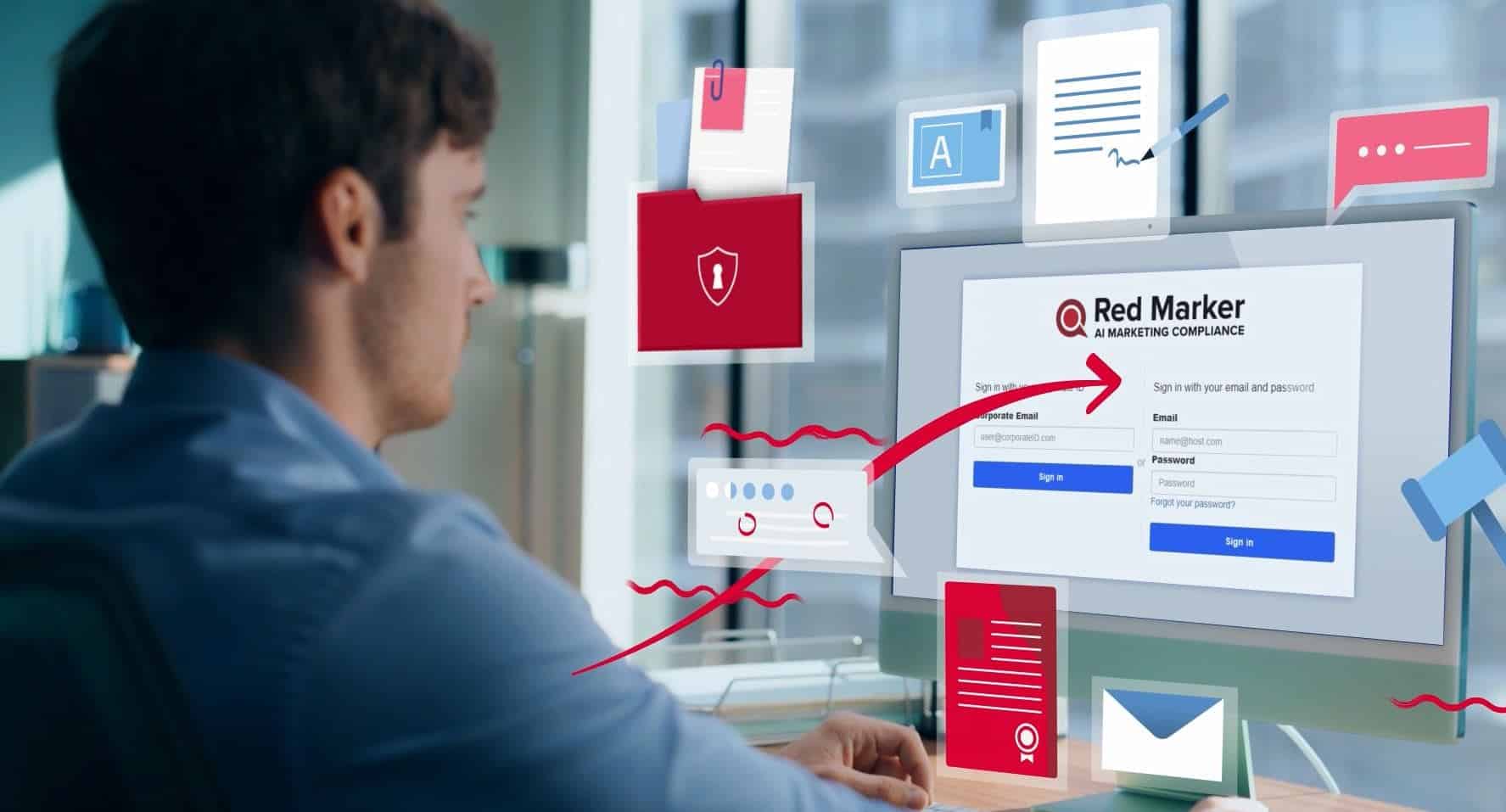

Insurers looking for the ideal solution can create, review and approve compliant content more efficiently with the help of advanced risk detection using our user-friendly and intuitive solution.

Enforcement for insurance advertising violations goes beyond cease and desist orders. Insurers are at risk of civil penalties and even losing their license. Red Marker provides technology to transform your marketing compliance review process, and can help you mitigate these potential consequences.

“Using Red Marker helps me catch things that I miss. It looks at things with fresh eyes every time, calling out variations. It has improved both risk detection across all reviews and it’s also helped us become more consistent as an organization.”

Marketing User, Insurer (AU)

Experience Red Marker’s Unique Advantages

Protecting Consumers Through Compliance Accuracy

Regulatory bodies such as the European Insurance and Occupational Pensions Authority, the National Association of Insurance Commissioners, and the Australian Securities & Investments Commission aim to protect consumers. Red Marker uses powerful customized risk detection to’ analyze material and flag any misleading claims, missing disclaimers, and more. Our custom logic checks for organization and industry-specific risks, helping ensure that insurance customers receive transparent and precise information at every touchpoint.

Uncompromized Advertising and Brand Consistency

Compliance is key in the insurance industry, but it’s just one piece of the puzzle. Maintaining brand consistency and preserving trust among your customers is equally critical. Red Marker works with you to develop the custom-logic that serves as a comprehensive automated checklist, ensuring your content aligns not only with regulatory stipulations but also with your unique brand guidelines. This means your brand’s tone of voice and narrative remains unified across all promotional and advertising materials.

Integration and Security You Can Trust

Red Marker is designed to fit seamlessly into your existing workflow and is particularly powerful when utilized by Marketing through integration with content creation tools such as Figma, Word, Powerpoint and Google Docs, or integrated with workflow and project management tools. Our robust API facilitates a smooth, interconnected ecosystem of compliant content creation and review. Moreover, we prioritize data security, implementing advanced security protocols to protect your sensitive information.

A Productivity Boost Like No Other

Red Marker’s automated analysis minimizes risks in promotional content, streamlines approvals, and frees your marketing team to focus on impactful strategies and creative.

Red Marker’s AI solution simplifies content review and correction, allowing your compliance and legal teams to operate efficiency and with high risk identification accuracy.

The result? Boosted productivity and a fast-tracked path to business growth.

Tired eyes miss things….Red Marker looks at things with fresh eyes every time, calling out variations. That lets me focus on more complicated aspects of the review.

Marketing Manager Top Insurer (USA)

Why Use Red Marker?

Automating your marketing and legal review processes not only saves resources but also minimizes compliance risk. With Red Marker, insurers can transform marketing compliance efforts, saving up to 30x the time spent on manual review processes. You can also:

- Identify and address misleading claims, high-risk phrasing, or inaccurate product information in real time.

- Improve review turnaround times and ensure increasingly compliant content.

- Streamline the regulatory approval process on promotional materials intended for distribution.

Seamless Integrations

Fast, accurate risk detection and feedback is available through the platforms and systems you already use daily, or contact us to discuss another tool we don’t have listed.

Figma

Figma

Google Docs

Google Docs

Microsoft PowerPoint

Microsoft PowerPoint

Microsoft Word

Microsoft Word

Frequently Asked Questions

Absolutely. Red Marker’s AI-driven compliance solution is based on custom logic, bespoke to your business needs. Designed to be flexible, we will work together to ensure any shifts in your marketing strategy, whether it’s a change in content style, guidelines, or target audience, is incorporated by Red Marker.

Yes, Red Marker is designed to adapt to various international regulatory landscapes. If your company decides to expand into new markets, our custom risk identification can be updated to reflect the specific compliance requirements of those regions.

Yes, we offer comprehensive education and ongoing assistance to ensure you get the most out of our solutions. Our team is always available to answer any questions and guide you through the process.

You can email support@redmarker.ai, or you can use our in-app support function to start a new conversation with us.

Dive Into Red Marker Resources

Taking the first step toward automated compliance? Not sure where to begin? Our guides to stronger, more efficient compliance workflows are here to help.