Compliance with financial regulations is critical for any business in the financial services sector. A single misstep — be it an advertisement missing a critical disclaimer or a web page showing an out-of-date promotion — can open the floodgates to regulatory scrutiny and cause damage to brand reputation. In this landscape, being well-versed in FINRA (Financial Industry Regulatory Authority) advertising regulations is undoubtedly crucial for maintaining the integrity and compliant aspects of transacting in the financial services industry.

What does FINRA stand for and why does it matter?

Established with the key objectives of safeguarding investors and ensuring market integrity, FINRA serves as the governing body for broker-dealers and their registered representatives — compliance with FINRA’s guidelines is fundamentally tied to a business’s credibility and reputation within the market.

FINRA’s influence extends beyond governance, it also creates the framework that determines the legitimacy of operations, dictating how businesses interact with customers, manage transactions, and even impacts advertising. Essentially, FINRA’s rules and regulations establish the criteria for a business’s legitimacy in the eyes of clients and regulatory bodies alike.

What constitutes FINRA compliance?

In the financial sector, adhering to FINRA rules is mandatory, particularly for advertising and marketing activities. While rules like 2265, 3310, and 4512 cover important ground — ranging from additional costs and anti-money laundering measures to handling customer account information — Rule 2210 holds specific significance for advertising campaigns.

Rule 2210 outlines the standards for all public communications, encompassing everything from social media posts to traditional advertising. Being compliant with this rule is an essential component of a trustworthy and compliant brand. It impacts how a business communicates with potential clients and ensures the positioning is transparent and accurate (learn more about the importance of readability here).

What impact does FINRA have on advertising and promotional materials?

Rule 2210 is crucial for any form of communication a business engages in. But what does this look like in practice, concerning advertising and promotional materials? Enter FINRA’s Advertising Regulation Department, this entity oversees the balance, fairness, and accuracy of digital and print communications. This department wields four key programs to ensure that the communications of broker-dealers meet the strict criteria for compliance: Filings review, complex reviews, spot checks, and outreach.

Filings review: This program serves as the initial layer of scrutiny. Communications filed under FINRA Rules 2210 are examined meticulously. A written review letter is then issued to the firm, detailing any necessary adjustments for compliance. In extreme instances, the firm may be directed to halt the use of a particular communication.

Complex reviews: Occurring usually during enforcement proceedings and examinations, these reviews dig deeper into communications that could potentially breach advertising rules. Depending on the outcome, the department may either take informal disciplinary action or escalate the issue for a more comprehensive examination.

Spot checks: Random audits target specific broker-dealers, especially those not usually under filing requirements. These checks are laser-focused on areas prone to regulatory concerns, such as new product types or certain investor protection issues. If any rule violations are uncovered, they are dealt with in a manner similar to complex reviews.

Outreach: The Advertising Regulation Department doesn’t stop at regulation. It actively invests in educating the industry by hosting annual conferences, and contributing to online training resources through e-learning and podcasts.

What are the best practices to remain FINRA-compliant in advertising?

Ensuring FINRA compliance in advertising requires a comprehensive approach blending technology, expert oversight, and proactive strategies. Here’s a rundown of best practices to stay compliant.

- Stay current on FINRA regulations: Rules and regulations in the financial services sector are not static. Register with FINRA to keep abreast of regulatory notices, events and updates to ensure advertising remains compliant.

- Prioritize data security: Compliance isn’t solely about what’s in your ads. The Security and Exchange Act requires protecting customer information, making data security an integral part of any compliance plan. Consider advanced cryptographic techniques, layered security protocols, and state-of-the-art threat detection systems.

- Anticipate enforcement actions: If the Advertising Regulation Department or any security firms find discrepancies in advertising, having a plan for rapid corrective action can save your firm from devastating consequences. Or better yet, instead of reacting to discrepancies, adopt powerful risk detection tools to gauge potential pitfalls in advertising.

- Invest in team education: From brokers to investment advisers, ensure everyone in your financial institution understands their supervisory responsibilities. Regular training and updates can serve as crucial preventive measures — and one way to elevate them is by incorporating case studies, simulation exercises, and real-world scenarios.

- Don’t underestimate the power of rapid corrective action: Swift responses to noncompliance should be paired with post-action reviews. Analyzing what went wrong, conducting root cause analyses, and integrating those insights back into the firm’s operations rectifies the issue and strengthens future safeguards.

How Red Marker can assist your compliance efforts

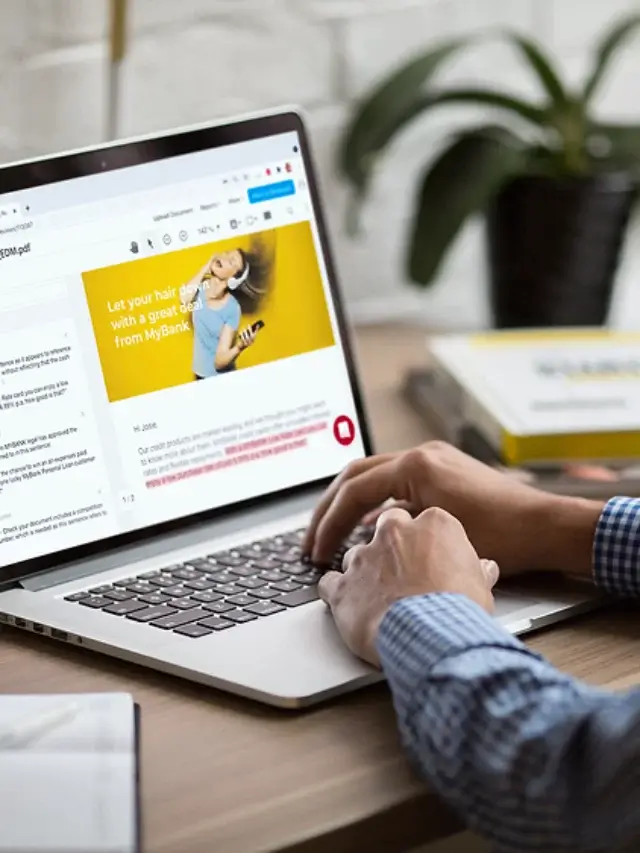

When it comes to transforming compliance reviews of advertising from a challenge into a strategic advantage, Red Marker is your partner. Using our automated custom-risk detection and actionable remedial feedback, we help you keep advertising and marketing communications aligned with FINRA compliance standards.

Our platform is designed to simplify this complex, ongoing process for your business. Want to see how it all comes together? Check out our resources or book a consultation today.